On April 1, 2025, voters in McLean County will decide on a proposed 1% County Schools Facility Tax (commonly known as a One-Cent Tax) to address school safety and facility needs in our public schools while also providing property tax relief. School districts in McLean County have united to bring forward this ballot question to voters.

On Tuesday, April 1, 2025, school districts in McLean County are asking voters to consider a 1% Illinois County Schools Facility Tax also known as a one-cent tax or sales tax. The one-cent tax would fund improvements to school facilities, creating safer, modern learning environments, while providing property tax relief to homeowners by offering an alternative funding source for local schools.

It’s estimated 35% of the one-cent tax revenue would be generated by visitors, commuters and non-residents of McLean County. Items not currently subject to sales tax– such as groceries, medications, vehicles and services– would not be taxed under this proposal.

How the Funds Will Be Used

By law, the revenue generated by the one-cent tax would be dedicated to:

- Safety and security improvements, including fire prevention, life safety measures, school resource officers, and mental health services

- Facility improvements, such as roof repairs, energy efficiency updates, renovations, durable equipment, and new school buildings

- Paying off facility bonds and/or reducing property taxes.

- If approved, each school district in McLean County would receive funding based on the number of students enrolled. Each school district decides how to allocate funds to meet their school community’s needs. A breakdown of estimated revenue for local districts is available on our website

Ballot Question

“Shall a retailers’ occupation tax and a service occupation tax (commonly referred to as a sales tax) be imposed in McLean County, Illinois, at a rate of 1% to be used exclusively for school facility purposes, school resource officers, and mental health professionals?”

Items Not Taxed Under This Proposal

- Groceries

- Prescription medications

- Vehicles (cars, trucks, boats)

- Farm equipment

- Professional/Personal Services (haircut, accounting, legal, etc.)

- Wholesale purchases

The One-Cent Tax applies only to purchases currently subject to Illinois sales tax. Example purchases include:

- Coffee at Starbucks ($5): 5¢

- Laptop at Best Buy ($500): $5

- Gas at BP ($60): 60¢

- T-shirt at Target ($20): 20¢

Improvements for Our Schools and Property Tax Relief

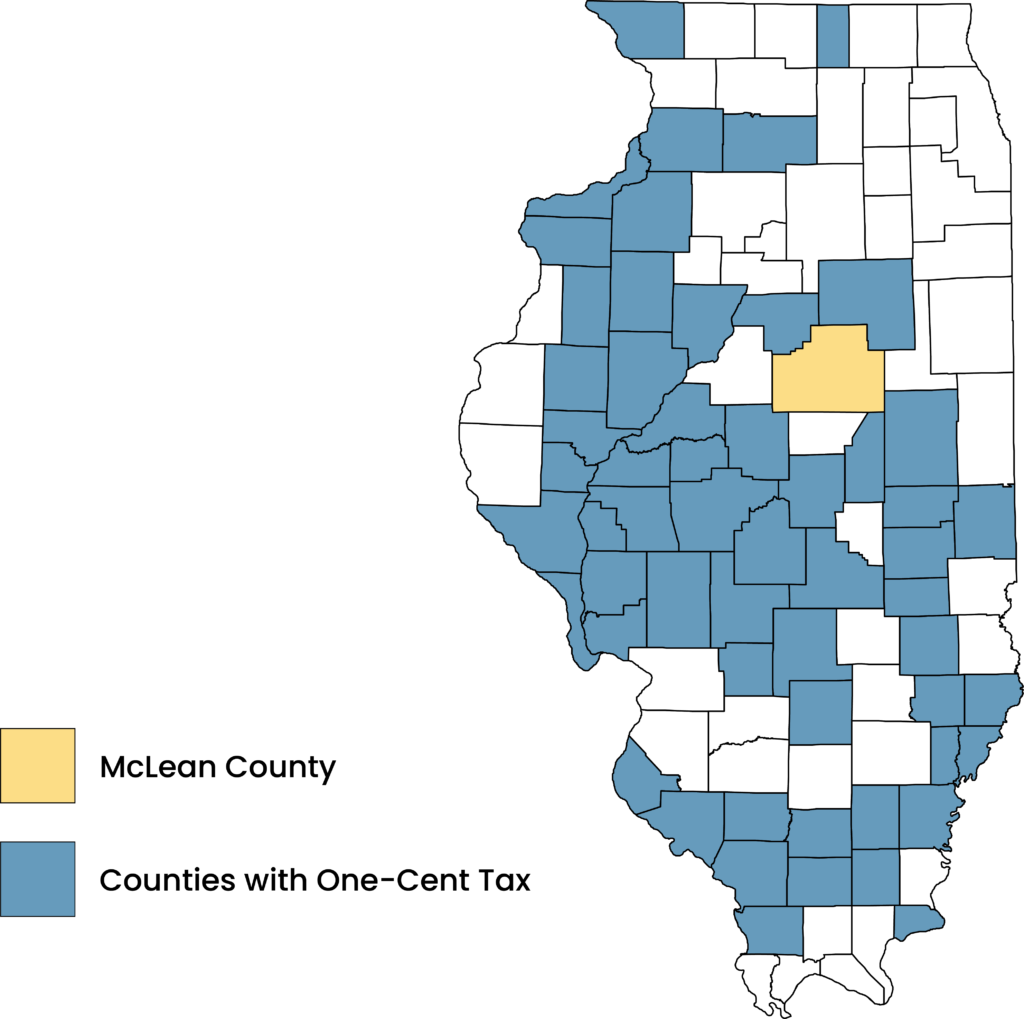

Many surrounding counties like Sangamon, Peoria, Champaign, and Macon already use the one-cent tax to support their schools.

If approved, each school district in McLean County would receive a share of the new one-cent tax revenue based upon student enrollment.

The funds would be distributed equally according to the number of students enrolled in each district, and each district’s Board of Education would decide how to allocate the funding within the state’s guidelines.

Frequently Asked Questions

Below are some frequently asked questions and answers to provide residents with more information about the one-cent tax referendum on April 1.

The Illinois County Schools Facility Sales Tax (CSFT) is a 1% sales tax option, commonly known as a one-cent tax, available to Illinois voters since 2007. If approved, it can shift funding for school facilities from property taxes to sales tax (Public Act 97-0542). Since 2007, nearly 60% of Illinois counties have approved a 1% sales tax including surrounding counties such as Sangamon, Peoria, Champaign, and Macon.

If approved, one cent per dollar spent would be applied to qualifying purchases made within the county to support public schools and offer property tax relief. For example, on a $1 purchase, one cent would be added to the price for qualifying purchases. Items that are not currently taxed under Illinois law, are not taxed under the County Schools Facility Tax.

Here are some examples of what the one-cent tax would cost on common, qualifying purchases:

- A coffee at Starbucks $5 = .05 cents

- Laptop at Best Buy $500 = $5

- Gas at BP $60 = .60 cents

- Book purchase on Amazon $5 = .05 cents

- T-shirt at Target $20 = .20 cents

- Bag of apples at Kroger $5 = No increase

- Medicine = No increase

If approved, the revenue generated from this one-cent tax would provide:

- Safety and security needs and supports: Safety and security are top priorities for our schools. The revenue raised through this tax can directly support school security needs, such as surveillance systems, secure entry points, and School Resource Officers. Supporting students academically, socially and emotionally is key to their success. Revenue raised can help expand access to mental health professionals providing students who may need support increased access resources needed to thrive. These items help ensure that our students and staff are in a safe environment and supportive, which is essential for learning and well-being.

- Property tax relief to fund schools and support the community: If approved, the revenue generated from this one-cent tax will provide an alternative source of funding for schools, reducing the reliance on property taxes. Unlike property taxes, which primarily impact homeowners, this one-cent tax would apply to qualifying purchases throughout the county. This option helps fund critical improvements for schools while easing the financial burden on property owners. This broadens the tax base to include visitors, non residents and renters who shop in the county offering a more equal way to support public schools. Additionally, a portion of the funds collected will be used to reduce debt and off-set costs offering some property tax relief for homeowners.

- Facility maintenance and upgrades: Maintaining and improving our school facilities is crucial for creating an optimal learning environment. Funds can be used for necessary repairs and upgrades to school buildings and facilities, including HVAC systems and general maintenance. These improvements ensure that our schools remain safe, up to code, and equipped to meet the needs of today’s students.

The revenue from this one-cent tax can help improve school facilities and provide safety, security and support for our students.

School districts will be faced with seeking alternative options, such as property tax increases, to fund facility improvements and safety and security needs.

School district leaders believe now is the right time to bring this question forward to voters due to financial challenges faced by all schools in the county, including rising costs, aging facilities and increased safety, security and support needs for students. Many schools across the county are facing critical facility needs as schools built in different eras require significant updates to meet safety, security and learning standards.

School leaders understand property tax payers are also under pressure from increasing property tax rates. The proposed 1% sales tax would help raise an estimated $30 million annually for school districts, with approximately 35% of the funds coming from people who live outside of McLean County without raising property taxes and providing some relief. This would help reduce the burden on local property tax payers.

Only items that are currently subject to sales tax will be subject to the CSFT. Some items are exempt from CSFT.

Example purchases that would be taxed include: Coffee at Starbucks ($5): 5¢ Laptop at Best Buy ($500): $5 Gas at BP ($60): 60¢ T-shirt at Target ($20): 20¢

Items that are not currently taxed under Illinois law, are not taxed under the County Schools Facility Tax. Items not subject to the one-cent tax include:

- Groceries

- Over the counter medicine and prescription drugs

- Cars, trucks, ATV’s boats, RV’s, mobile homes

- Farm equipment, parts, inputs

- Services (accounting, legal, etc.)

- Wholesale level purchases

By law, the revenue generated by this one-cent tax must be used for:

- Paying off facility bonds and/or property tax reduction

- Facility improvements including:

- New school facilities including athletics

- Additions and renovations

- Land acquisition

- Architectural planning

- Energy efficiency improvements

- Durable equipment

- Demolition

- Roof repairs

- Safety and security improvements including fire prevention and life safety

- School Resource Officers and Mental Health Providers

Funds from the one-cent tax may not be used for staff salaries and benefits*, instructional supplies, books, computers, buses, or other operating expenses.

(*Recent changes in Illinois CSFT allow schools to use these funds only for salaries/benefits for School Resource Officers and/or Mental Health Professionals)

Each school district’s Board of Education determines how to allocate the funding within the state’s guidelines.

Yes. Every school district in the county will benefit. The one-cent tax revenue will be collected from all cities and townships in the county and distributed to school districts based upon student enrollment.

Revenue is distributed based upon the number of students living in the county and attending public schools, regardless of which school they attend.

| School District Name | Approximate Number of Students in McLean County | Estimated Annual Share of County School Facility Tax Revenue |

|---|---|---|

| Bloomington SD 87 | 4,841 | $6,253,117 |

| Blue Ridge 18 | 63 | $81,377 |

| El Paso Gridley 11 | 344 | $444,345 |

| Gibson City Melvin Sibley 5 | 12 | $15,500 |

| Heyworth CUSD 4 | 877 | $1,132,820 |

| LeRoy CUSD 2 | 755 | $975,233 |

| Lexington CUSD 7 | 511 | $660,058 |

| McLean Unit 5 | 12,340 | $15,939,571 |

| Olympia CUSD 16 | 726 | $937,774 |

| Prairie Central 8 | 326 | $421,094 |

| Ridgeview CUSD 19 | 520 | $671,684 |

| Tri Valley CUSD 3 | 1,131 | $1,460,912 |

| Total | 22,446 | $28,993,485 |

Yes. Revenue will be generated from people who live outside of McLean County. Any person who is visiting or traveling through the county and makes a purchase that qualifies would contribute to the revenue for local schools. It is estimated that 35% of all purchases in McLean County are made by non-residents. Additionally, not all of the remaining 65% of purchases are made by property owners in this county– This one-cent tax would allow non-property owners to help support local schools, reducing some of the financial burden on property owners.

If approved, McLean County will join its neighboring counties that are investing in their schools through a one-cent tax.

Shall a retailers’ occupation tax and a service occupation tax (commonly referred to as a sales tax) be imposed in The County of McLean, Illinois, at a rate of 1% to be used exclusively for school facility purposes, school resource officers, and mental health professionals?

Election day is Tuesday, April 1, 2025. Polls are open 6 a.m. to 7 p.m. on Election Day. Early voting is available starting Feb. 20. For details about how to vote, including voting locations and how to register, visit www.elections.il.gov.

To learn more, contact your local school district by visiting their website or attend an upcoming informational meeting.

Resources

As the April 1, 2025 election approaches, we’re committed to keeping you informed every step of the way. In the coming weeks, we’ll be adding campaign resources to this page.

Voting Information

Election Day is Tuesday, April 1, 2025 | Polls open: 6 a.m. – 7 p.m.

Early Voting begins February 20, 2025

For details on voter registration, mail-in voting, polling locations, and more, visit www.elections.il.gov.

More Voting Info

Early Voting Information for the April 1 Election in McLean County

Residents of McLean County can vote early in the upcoming April 1 Consolidated Election. Early voting is available at different locations based on your residency in McLean County.

McLean County Election Authorities:

- McLean County Clerk’s Office manages elections for all areas of the county except the City of Bloomington.

- Bloomington Election Commission handles elections within the City of Bloomington.

Early In-Person Voting for McLean County (excluding City of Bloomington residents)

Residents of McLean County (outside the City of Bloomington) can vote early at the McLean County Clerk’s Office, located at the Government Center, 115 E. Washington St., Bloomington, IL.

Early Voting Dates and Hours at the McLean County Clerk’s Office:

- Thursday, Feb. 20 – Friday, Feb. 21: 8:30 AM – 4:30 PM

- Monday, Feb. 24 – Friday, Feb. 28: 8:30 AM – 4:30 PM

- Monday, March 3 – Friday, March 7: 8:30 AM – 4:30 PM

- Monday, March 10 – Friday, March 14: 8:30 AM – 4:30 PM

- Monday, March 17 – Friday, March 21: 8:30 AM – 4:30 PM

- Saturday, March 22 – Sunday, March 23: 9:00 AM – 5:00 PM

- Monday, March 24 – Friday, March 28: 8:30 AM – 7:00 PM

- Saturday, March 29 – Sunday, March 30: 9:00 AM – 5:00 PM

- Monday, March 31: 8:30 AM – 7:00 PM

Early Voting for Residents of the City of Bloomington

Residents of the City of Bloomington can vote early at the Bloomington Election Commission, located at 121 N. Main St., Bloomington, IL.

Early Voting Dates and Hours at the Bloomington Election Commission:

- Thursday, Feb. 20 – Friday, Feb. 21: 8:30 AM – 4:30 PM

- Monday, Feb. 24 – Friday, Feb. 28: 8:30 AM – 4:30 PM

- Monday, March 3 – Friday, March 7: 8:30 AM – 4:30 PM

- Monday, March 10 – Friday, March 14: 8:30 AM – 4:30 PM

- Monday, March 17 – Friday, March 21: 8:30 AM – 4:30 PM

- Saturday, March 22 – Sunday, March 23: 9:00 AM – 5:00 PM

- Monday, March 24 – Friday, March 28: 8:30 AM – 7:00 PM

- Saturday, March 29 – Sunday, March 30: 9:00 AM – 5:00 PM

- Monday, March 31: 8:30 AM – 7:00 PM

Vote Early by Mail

Residents can also vote early by mail. To vote by mail:

- Submit a Vote By Mail Online Application, OR

- Print the mail-in form and mail it to the appropriate election office (McLean County Clerk’s Office or City of Bloomington Election Commission).

- Call your local election office to request a Vote by Mail Application pre-printed with your voter information,

- Visit your designated election office to complete the form in person.

For more details to vote by mail, follow the links based on your residency:

- Vote by mail for City of Bloomington residents

- Vote by mail for McLean County residents (non-City of Bloomington)

Register to Vote and Cast Your Ballot

If you are not registered to vote, you can register and vote at the early voting locations. Be sure to bring the required identification, with at least one form showing your current address. You can also register to vote online.

For more information on early voting in Illinois, visit the Illinois State Board of Elections page on Early Voting in Illinois.